Easing lockdown boosts Easter lamb

Monday, 24 May 2021

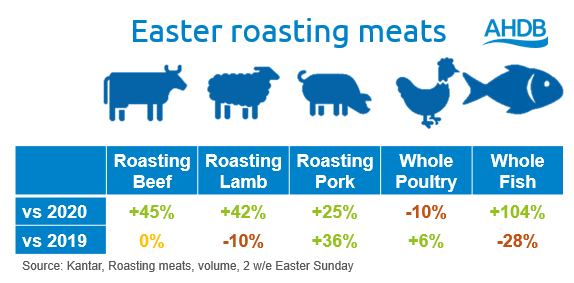

Easter bounced back this year as restrictions began to ease, in contrast to last year when Easter was hit by the first and strictest lockdown. This was positive for Easter categories including roasting lamb which saw volume growth of 42% year on year (Kantar, 2 w/e 4 April 2021).

The return of the Easter occasion

Easter is an occasion where many celebrate with family and friends. Timing of easing restrictions allowed people to meet up and socialise for the first time since November, so Easter was perfectly situated this year, especially in contrast to last. Research from Kantar saw 61% of consumers saying they were looking forward to socialising with friends. For food, 26% were planning an Easter lunch or dinner and 23% were hoping to BBQ (weather permitting). There were still restrictions in place and this was still not a ‘normal’ Easter, particularly as households were only able to mix outdoors. According to IGD, three in five said they celebrated with fewer people than they usually would.

A theme we have seen throughout the year has been consumers treating themselves to foods. The lack of celebrations last year meant there was more anticipation around Easter this year. Easter eggs, hot cross buns and chocolate gifting all experienced double-digit growth in value, compared to 2020 and 2019 (Kantar, 3 w/e Easter Sunday).

Take-home grocery for the 3 weeks to Easter Sunday grew by 7.6% compared to last year, an additional £556m according to Kantar. Although not to the same extent as Easter 2020, shoppers continued to restrict how often they shopped, with trips down 10% compared to Easter 2019, showing that despite the easing of restrictions, some shoppers are still being cautious.

Shopping online continued to see strong growth as we have seen throughout this year, with Easter categories online sales growing 68% year on year. Many retailers had strong Easter sections on their online stores and encouraged consumers to buy with deals and promotions on the home page. However, there are still opportunities to push this further by retailers promoting Easter roasts or meal occasions on the home page, as well as chocolates and confectionery.

Retailers’ online offerings have improved greatly over the last year and many are now used to the larger volume of online demand. However, over Easter many still sold out of delivery and click and collect slots, so more could be done in the future to meet shopper demand at key consumer events.

Impact on roasting meats

Easter is an important occasion for roasting meats, accounting for 14% of total meat, fish and poultry (MFP) sales volume (Kantar, 2 w/e 4 April 2021). This is especially true for lamb as the two weeks to Easter Sunday accounted for 15% of all roasting lamb sold in the last year. This Easter was particularly positive year on year for red meat, but lamb is still not back to pre-pandemic levels, in contrast to the other main Easter categories.

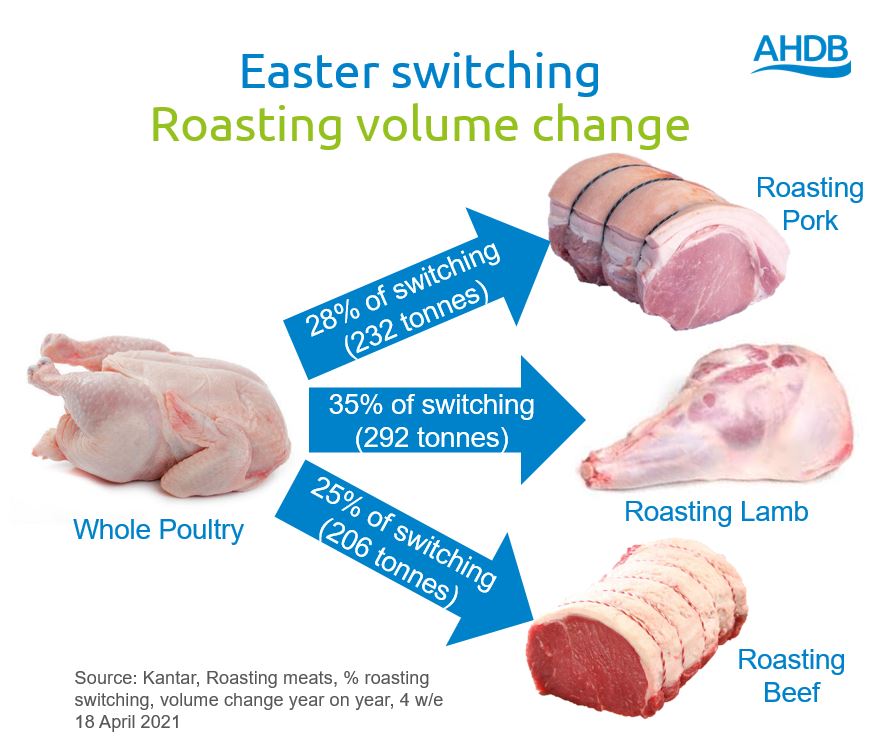

Much of the gain for red meat came from attracting shoppers back to the roasting category after a year away last Easter. Many who chose whole poultry last year, due to its versatility, switched to red meat with all categories gaining from chicken. Nearly a third of roasting meats were bought on promotion, which may have enticed shoppers.

Lamb was the second most popular meat, behind chicken, with 10.4% of households buying roasting lamb in the two weeks to Easter compared to 15.6% buying a whole chicken (Kantar, 2 w/e 4 April 2021). However, there could still be room to encourage more people to buy lamb and regain some of the losses versus 2019.

Lamb is a favourite with older shoppers in particular, many of whom were more cautious both this year and last. Shoppers aged over 55 were less likely to celebrate Easter this year, which may have impacted lamb’s return. In the future, when hopefully these shoppers are more confident and lockdowns mean they will be able to host their whole families again, reminding them of their love of lamb and the traditional and tasty elements will help to boost lamb sales.

Roasting pork saw growth compared to both Easter 2020 and 2019. Research by AHDB with YouGov says 42% of shoppers have become more price conscious compared to before the pandemic (Feb-21). Therefore, pork is in a good position with shoppers as it has a lower price position compared to other red meats, which may attract those who are looking to save money on their weekly shop.

Over the past year, many shoppers have stayed local which has benefitted butchers. The trend continued this Easter, with butcher shopper numbers reaching a five year high. Volumes of roasting joints and whole poultry also saw strong growth at butchers and were up 14.8% compared to last Easter and 20.1% vs 2019. Holding on to these new shoppers is key for butchers to continue to see positive growth.

A less traditional Easter

Despite roasting joints bouncing back year-on-year, there is evidence that many are opting for a less traditional celebration. Over the last five years, roasting joints have become less important over Easter as they take a smaller share of total MFP volumes.

As there were still restrictions in place, consumers still couldn’t eat inside with members outside their household. Therefore, there were opportunities for more outdoor dining and BBQs seemed to be a popular option, despite Easter being three weeks earlier than it was in 2019. There was a spike in Google searches for BBQ just before the Easter week and there was also strong volume growth for steaks (+17.6%), burgers and grills (+6.3%) and sausages (+11.0%) over Easter compared to 2019.

The BBQ season has been starting earlier and earlier so making sure products are in stock for shoppers looking to begin the summer early is critical.

Opportunities

- Remind shoppers of the tradition of lamb at Easter and tying lamb in with larger gatherings and celebrations for next year. Especially targeting those older consumers who may have the whole family round for traditional celebrations.

- Online holds many opportunities for promoting Easter roasts. Ensure red meat has a prominent position on the homepages of retailer websites to increase awareness with shoppers.

- Retailers need to meet consumer demand for delivery and collection slots. While many encouraged their customers to shop early, this is a challenge for those wanting fresh meat and produce for the Easter Sunday roast.

- For pork, Easter could be an opportunity, especially as it is very price competitive and proving popular with shoppers despite less promotional activity. Encourage shoppers to choose pork as a cost-effective Easter centrepiece.

- We can’t control the weather but with Easter next year being towards the end of April, any sign of the sun could see consumers dusting off their BBQs early. Having the right stock in store to cater to these earlier BBQ occasions could be a winning strategy.

Topics:

Sectors: