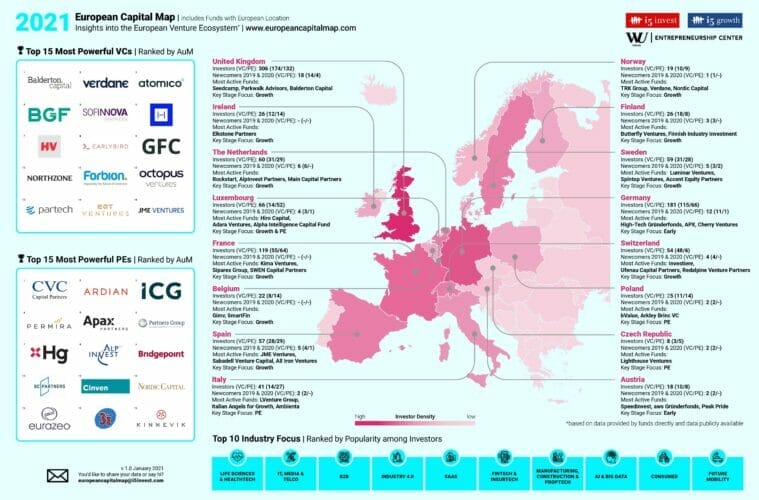

i5invest and the Vienna University of Economics’ Entrepreneurship Center published ‘The European Capital Report 2021’, revealing that both Venture Capital and Private Equity Funds have substantially been gaining ground despite Covid-19. With 64 new European funds that have been established in the last 24 months, the total number of players rises to 676, including 443 Venture Capital and 233 Private Equity Funds located in Europe. An extensive effort to map out the ecosystem reveals new insights.

Venture Capital and Private Equity Funds trends for 2021

With a substantial margin, the United Kingdom still leads the ranking of countries home to the most investors in Europe (306), followed by Germany (181), France (119), and Luxembourg (66). The last 24 months however show an interesting trend: It is not the United Kingdom that has been seeing the most Venture Capital and Private Equity newcomers lately, but the region of Germany, Switzerland, and Austria. “With more than a quarter of all new European funds established in this region, we’re noticing an interesting development also in hindsight of the Brexit”, says Herwig Springer, CEO of i5invest.

Most Powerful European Funds

The most powerful European Venture Capital Funds based on Assets under Management in 2021 are Balderton Capital, Verdane, Atomico, BGF and Sofinnova Partners, with CVC Capital Partners, Ardian, ICG, Permira and Apax Partners leading the Private Equity Ranking. The combined European Assets under Management of all funds covered by the European Capital Report 2021 amount to EUR 3 036.84 bn.

The ranking of the most active European funds based on number of investments in 2020 is led by Hiventures from Hungary (200 investments), Germany’s HTGF (160), Kima Ventures from France (100), UK based Seedcamp (92) and Speedinvest headquartered in Austria (86).

Regional Insights: Ireland

In total Ireland is home to 26 investors (11 Venture Capital Funds, 14 Private Equity Funds and one Corporate Venture Capital Funds), with a strong focus on financing growth-stage companies.

The most powerful funds in Ireland based on Assets under Management are Scottish Equity Partners (Glasgow), Atlantic Bridge Capital, Enterprise Ireland, Elkstone Partners and ACT Venture Capital (all based in Dublin). The most active investor in Ireland is Elkstone Partners, with 14 investments in 2020.

The primary investment focus in Ireland is Life Science and Health as well as IT Media and Telco; B2B; Manufacturing, Construction and PropTech; and Lifestyle, Leisure and Entertainment.

European Newcomer Funds

In the last 24 months 64 new funds have been established across Europe with a strong focus on early-stage investments in Industry 4.0, Life Science and HealthTech. The most powerful newcomers based on Assets under Management are London based Corten Capital, Röko from Sweden, a/o PropTech headquartered in the UK, Future Energy Ventures from Germany and NordicNinja VC based in Finland. Among the newcomers are four Corporate Venture Capital Funds: Smart Works from Austria, Helen Ventures from Finland, Sparrow Ventures from Switzerland and DNV GL Ventures from Norway.

Corporate Venture Capital in Europe

With only four new funds, the Corporate Venture Capital (CVC) ecosystem in Europe has not been showing substantial growth. In total there are 55 CVCs located across Europe in 2021, most powerful based on Assets under Management are Novo Holdings from Denmark, Rabo Corporate Investments based in The Netherlands, Novartis Venture Fund from Switzerland and BMW i Ventures from Germany. Home to the most CVCs is the United Kingdom (18), followed by Germany (16), and Switzerland (6).

The key investment verticals for CVCs in Europe are AI and Big Data, Industry 4.0, Life Science & HealthTech, Software as a Service and Future of Mobility. “For 2021 we’re hoping to see many more corporates making Venture Capital part of their innovation strategy”, says Stephan Jung from the WU Entrepreneurship Center.

US Funds with European Presence

124 US funds have established a presence in Europe, the preferred cities for office locations being London, Paris, Luxembourg, and Berlin. The investment focus of US headquartered funds in Europe is primarily growth-stage with the most popular industries being Life Science & HealthTech, IT, Media, and Telecommunications, FinTech and InsurTech, everything B2B and Industry 4.0.

Investments Trends 2021

Most popular investment focus among European funds in 2021 is Life Science & Health, followed by IT, Media and Telco, everything B2B and Industry 4.0. In terms of stage focus, funds based in Germany and Austria prefer to invest early-stage, while the rest of Europe continues a stronger focus on funding growth-stage companies in 2021.

The full report including all investors part of the European Capital Ecosystem as well as detailed portraits on all newcomers can be downloaded for free on www.europeancapitalmap.com.

About the Publishers

i5invest

As international tech M&A, corporate finance advisory, investor and growth accelerator, the primary focus of i5invest and i5growth is to support growth and manage corporate development and cross-border M&A processes for extraordinary tech companies. Operating out of Berlin, Palo Alto, San Francisco and Vienna, i5 has set up over 150 strategic partnerships and international M&A transactions with companies such as Google, Verisign, Samsung, Cisco, Telefonica, NBC, Naspers, Volkswagen, Amdocs, IAC, Pfizer/Zoetis, Microsoft, Facebook, Nvidia, Airbus, Toronto Stock Exchange and many other global tier 1 technology giants.

www.i5invest.com

[email protected]

WU Entrepreneurship Center

Since June 2015, WU Entrepreneurship Center (www.wu.ac.at/gruenden) has been the central place to go to for guidance on student entrepreneurship & spin-offs. As a think tank, we want to understand the entrepreneurial ecosystem ranging from founders, investors, service and ecosystem developers by providing data, realizing studies and sharing expertise.

It is our long-term goal to fully develop the extraordinary potential of university-affiliated start-ups and help increase the number and especially the quality of entrepreneurial activities among students, alumni, and faculty.

www.wu.ac.at/en/starting-up

[email protected]

More stories here.

More about Irish Tech News

Irish Tech News are Ireland’s No. 1 Online Tech Publication and often Ireland’s No.1 Tech Podcast too.

You can find hundreds of fantastic previous episodes and subscribe using whatever platform you like via our Anchor.fm page here: https://anchor.fm/irish-tech-news

If you’d like to be featured in an upcoming Podcast email us at [email protected] now to discuss.

Irish Tech News have a range of services available to help promote your business. Why not drop us a line at [email protected] now to find out more about how we can help you reach our audience.

You can also find and follow us on Twitter, LinkedIn, Facebook, Instagram, TikTok and Snapchat.